If you’re running a small business, chances are you created your business to solve a problem or offer a creative product – not because you’re an accounting pro (unless of course, your business is an accounting firm).

Whether you love crunching numbers or consider yourself the more creative type, entrepreneurs can’t afford to gloss over the financial health of their businesses. Learning about the fundamentals of business accounting is a valuable undertaking because it can save you a great deal of time, money, and legal trouble down the road.

We wrote this guide to ease you into the world of business accounting, and by the end, you’ll feel equipped to tackle your own business’s accounting (or find someone who can help).

We wrote this guide to ease you into the world of business accounting, and by the end, you’ll feel equipped to tackle your own business’s accounting (or find someone who can help).

Bookmark this to reference it later and use the chapter links below to jump around to different sections.

What is business accounting?

Accounting is the process of systematically recording, analyzing, and interpreting your business’s financial information. Business owners use accounting to track their financial operations, meet legal obligations, and make stronger business decisions.

Accounting is a necessary part of running a business. It’s a task you’ll either need to master or outsource — or both. Let’s ease into the topic by first reviewing accounting terminology.

Accounting Basics

Regardless of who manages your business accounting, it’s wise to understand accounting basics. If you can read and prepare these basic documents, you’ll understand your business’s performance and financial health — as a result, you’ll have greater control of your company and financial decisions.

Here are the documents and calculations we recommend mastering, even if you work with a professional, consulting agency, or have hired a certified public accountant (CPA). They provide valuable snapshots and measures of your business performance.

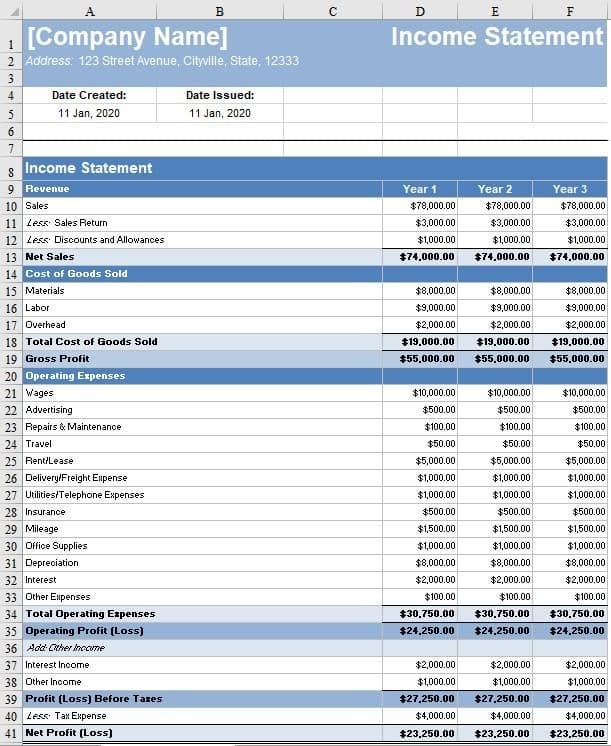

1. Income Statement

An income statement shows your company’s profitability and tells you how much money your business has made or lost

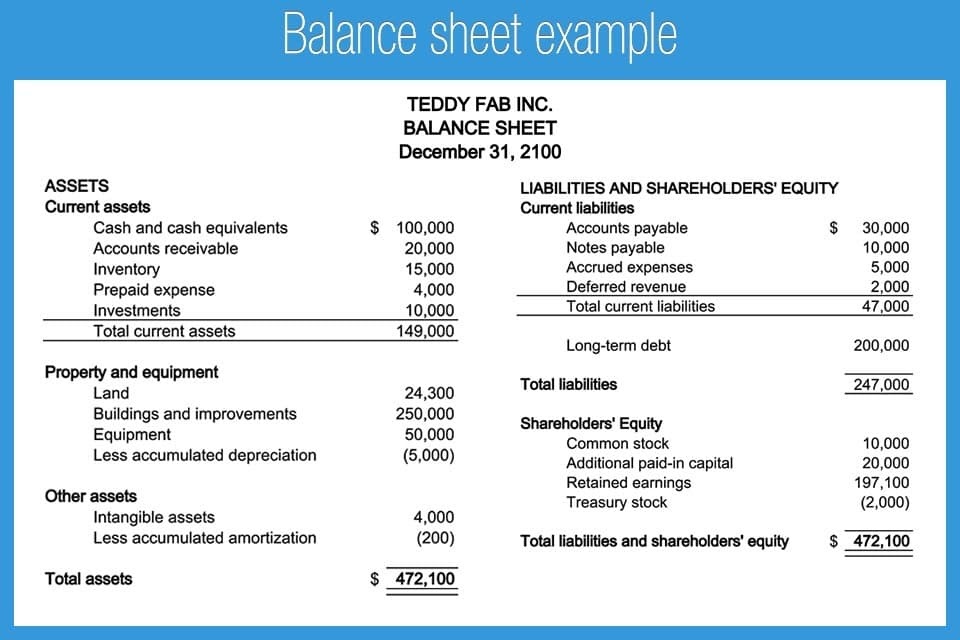

2. Balance Sheet

A balance sheet is a snapshot of your business’ financial standing at a single point in time. A balance sheet will also show you your business’s retained earnings, which is the amount of profit that you’ve reinvested in your business (rather than being distributed to shareholders).

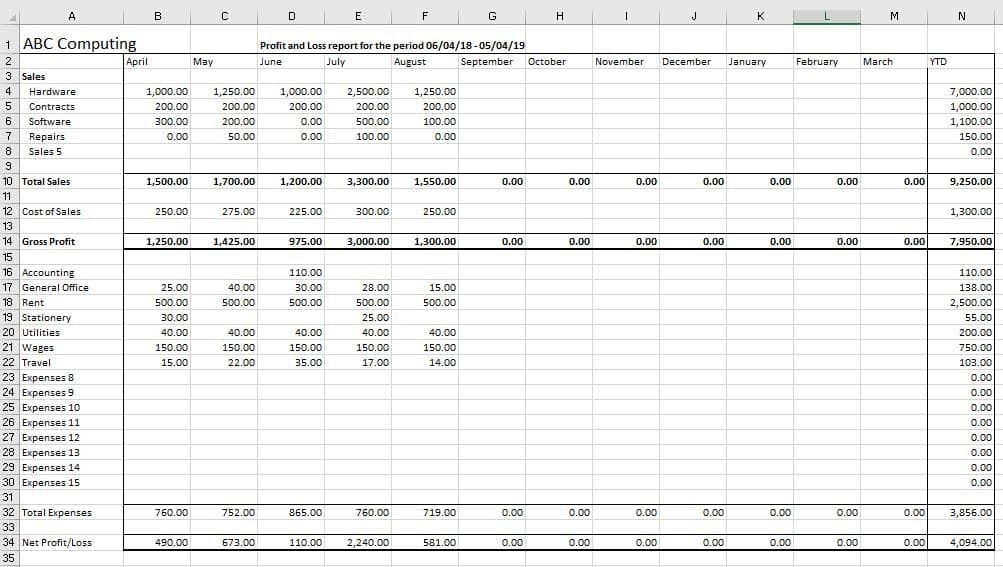

3. Profit and Loss (P&L) Statement

A profit and loss (P&L) statement is a snapshot of your business’s income and expenses during a given time period (e.g. quarterly, monthly, or yearly). This calculation will also be reflected on your business’s Schedule C tax document.

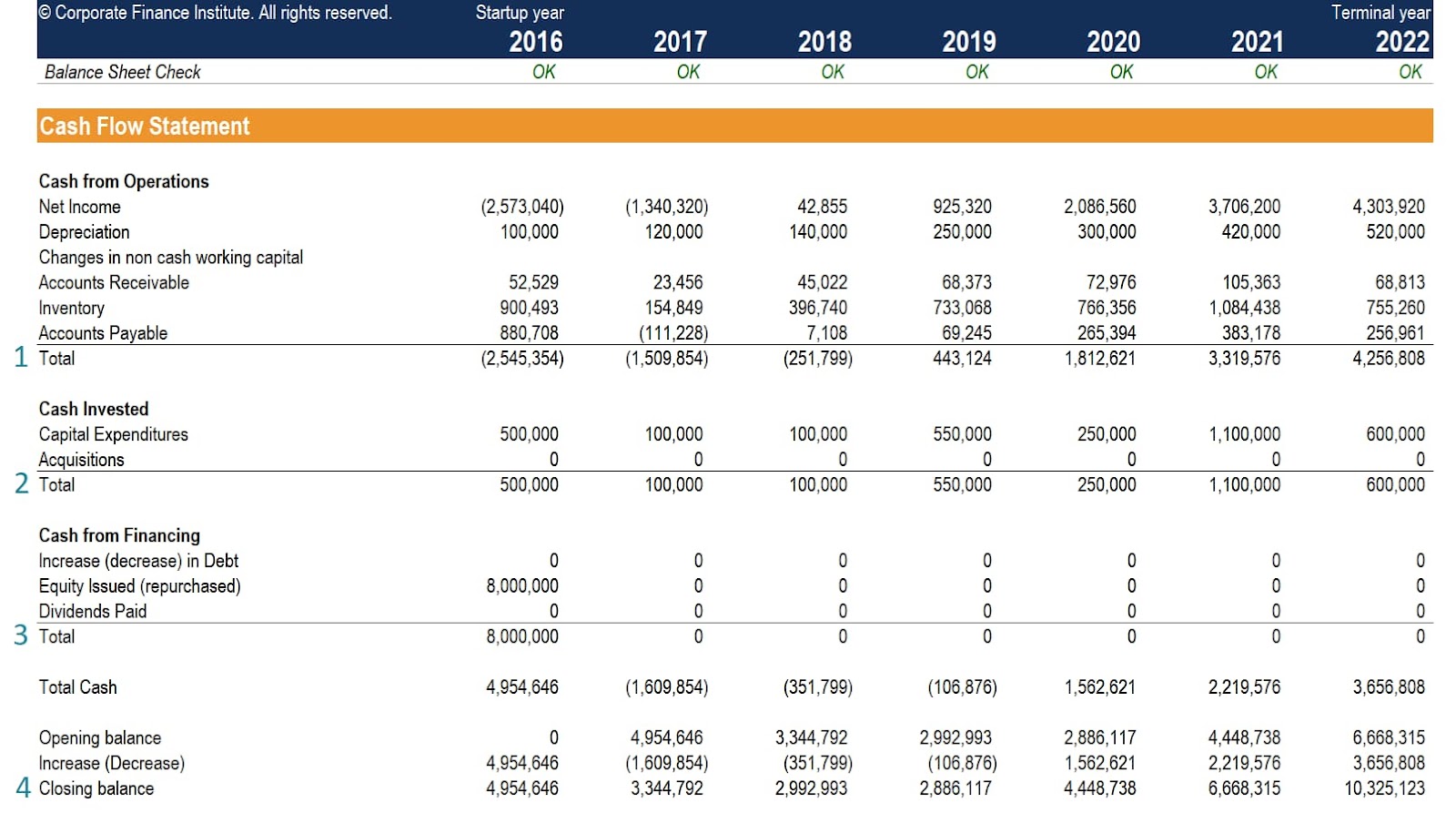

4. Cash Flow Statement

A cash flow statement analyzes your business’s operating, financing, and investing activities to show how and where you’re receiving and spending money.

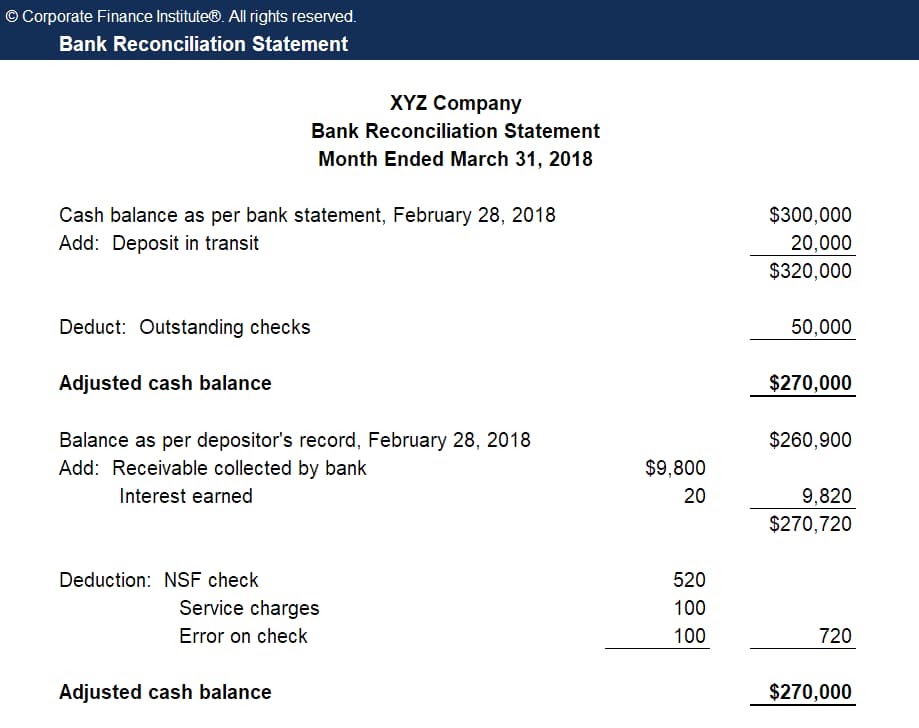

5. Bank Reconciliation

A bank reconciliation compares your cash expenditures with your overall bank statements and helps keep your business records consistent. (This is the process of reconciling your book balance to your bank balance of cash.)

Basic Accounting Terms

These 15 terms will create the foundation on which you’ll build your knowledge of business accounting. While some of these terms might not apply to your business right now, it’s important to develop a holistic understanding of the subject in case you expand or move into another type of business.

1. Debits & Credits

Not to be confused with your personal debit and credit cards, debits and credits are foundational accounting terms to know.

A debit is a record of all money expected to come into an account. A credit is a record of all money expected to come out of an account. Essentially, debits and credits track where the money in your business is coming from, and where it’s going.

Many businesses operate out of a cash account – or a business bank account that holds liquid assets for the business. When a company pays for an expense out of pocket, the cash account is credited, because money is moving from the account to cover the expense. This means the expense is debited because the funds credited from the cash account are covering the cost of that expense.

Here’s a simple visual to help you understand the difference between debits and credits:

| debits | Credits |

| Increase assets | Decrease assets |

| Decrease liabilities | Increase liabilities |

| Decrease revenue | Increase revenue |

| Increase the balance of expense accounts | Decrease the balance of expense accounts |

| Decrease the balance of equity accounts | Increase the balance of equity accounts |

2. Accounts Receivable & Accounts Payable

Accounts receivable is money that people owe you for goods and services. It’s considered an asset on your balance sheet. For example, if a customer fulfills their invoice your company’s accounts receivable amount is reduced because less money is now owed.

Accounts payable is money that you owe other people and is considered a liability on your balance sheet. For example, let’s say your company pays $5,000 in rent each month. Here’s how that would be recorded in your financial records before that amount is paid out.

| date | account | debit | credit |

| 7/31/21 | Rent | 5000 | |

| 7/31/21 | Accounts Payable | 5000 |

Once that value is paid, here’s how that would be recorded in your company’s financial records:

| date | account | debit | credit |

| 8/1/21 | Accounts Payable | 5000 | |

| 8/1/21 | Cash Account | 5000 |

3. Accruals

Accruals are credits and debts that you’ve recorded but not yet fulfilled. These could be sales you’ve completed but not yet collected payment on or expenses you’ve made but not yet paid for.

(Why not wait to record the activity until the payment is complete? We’ll answer this question when we explain the accrual accounting method later.)

4. Assets

Assets are everything that your company owns — tangible and intangible. Your assets could include cash, tools, property, copyrights, patents, and trademarks.

5. Burn Rate

Your burn rate is how quickly your business spends money. It’s a critical component when calculating and managing your cash flow.

To calculate your burn rate, simply pick a time period (such as a quarter or a year). Subtract your on-hand cash amount at the end of that period from your on-hand cash at the beginning, then divide that number by the number of months in the period (or by your chosen cadence).

6. Capital

Capital refers to the money you have to invest or spend on growing your business. Commonly referred to as “working capital,” capital refers to funds that can be accessed (i.e. cash in the bank) and don’t include assets or liabilities.

7. Cost of Goods Sold

The cost of goods sold (COGS) or cost of sales (COS) is the cost of producing your product or delivering your service.

COGS or COS is the first expense you’ll see on your profit and loss (P&L) statement and is a critical component when calculating your business’s gross margin. Reducing your COGS can help you increase profit without increasing sales.

8. Depreciation

Depreciation refers to the decrease in your assets’ values over time. It’s is important for tax purposes, as larger assets that impact your business’s ability to make money can be written off based on their depreciation. (We’ll discuss expenses and tax write-offs later on.)

9. Equity

Equity refers to the amount of money invested in a business by its owners. It’s also known as “owner’s equity” and can include things of non-monetary value such as time, energy, and other resources. (Ever heard of “sweat equity”?)

Equity can also be defined as the difference between your business’s assets (what you own) and liabilities (what you owe).

A business with healthy (positive) equity is attractive to potential investors, lenders, and buyers. Investors and analysts also look at your business’s EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization.

10. Expenses

Expenses include any purchases you make or money you spend in an effort to generate revenue. Expenses are also referred to as “the cost of doing business”.

There are four main types of expenses, although some expenses fall into more than one category.

- Fixed expenses are consistent expenses, like rent or salaries. These expenses aren’t typically affected by company sales or market trends.

- Variable expenses fluctuate with company performance and production, like utilities and raw materials.

- Accrued expenses are single expenses that have been recorded or reported but not yet paid. (These would fall under accounts payable, as we discussed above.)

- Operating expenses are necessary for a company to do business and generate revenue, like rent, utilities, payroll, and utilities.

11. Fiscal Year

A fiscal year is the time period a company uses for accounting. The start and end dates of your fiscal year are determined by your company; some coincide with the calendar year, while others vary based on when accountants can prepare financial statements.

12. Liabilities

Liabilities are everything that your company owes in the long or short term. Your liabilities could include a credit card balance, payroll, taxes, or a loan.

13. Profit

In accounting terms, profit — or the “bottom line” — is the difference between your income, COGS, and expenses (including operating, interest, and depreciation expenses).

You (or your business) are taxed on your net profit, so it’s important to proactively plan for your tax liability. Do this by staying on top of your net profit amount, setting aside some of your revenue in a separate savings account, or paying your estimated taxes every quarter (like employer withholding).

14. Revenue

Your revenue is the total amount of money you collect in exchange for your goods or services before any expenses are taken out.

15. Gross Margin

Your gross margin (or gross income), which is your total sales minus your COGS — this number indicates your business’s sustainability.

Again, these terms are merely an introduction to business accounting. However, they will help you better understand how to do accounting for your small business — which we review next.

Accounting Principles

The Generally Accepted Accounting Principles (GAAP) serve as a blueprint for accounting activity across sectors and industries in the U.S. The GAAP was established by the Financial Accounting Standards Board (FASB) to ensure quality standards for accounting activities.

By law, accountants representing all publicly traded companies must comply with GAAP. Let’s break down what these principles are.

1. Principle of Regularity

The working accountant is compliant with GAAP rules and regulations.

2. Principle of Consistency

This principle states that the accountant has reported all information consistently throughout the reporting process. Under the principle of consistency, accountants must clearly state any changes in financial data on financial statements.

3. Principle of Sincerity

The accountant provides an accurate financial picture of the company.

4. Principle of Permanence of Methods

All financial reporting methods should be consistent across time periods.

5. Principle of Non-Compensation

All financial information, both negative and positive, is disclosed accurately. The proper reporting of financial data should be conducted with no expectation of performance compensation.

6. Principle of Prudence.

Financial data should be presented based on factual information, not speculation.

7. Principle of Continuity

This principle states the assumption that the company will continue operations.

8. Principle of Periodicity

All accounting entries should be reported during relevant time periods.

9. Principle of Materiality

Accountants should aim to provide full disclosure of all financial and accounting data in financial reports.

10. Principle of Utmost Good Faith

According to this principle, parties should remain honest in all transactions.

How To Do Accounting For Small Business

- Open a business bank account linked to all points of sale.

- Itemize all expenses by department.

- Adhere to all income, employment, and excise taxes.

- Set up a payroll system.

- Identify the right payment gateway for your needs.

- Understand the tax obligations for your type of business.

- Regularly review and evaluate your processes.

- Consult with a professional or CPA.

Accounting is a complex discipline. But if you’re not an accountant yourself, you don’t need to know everything about accounting — only the practices and parts that have to do with your financial operations, legal obligations, and business decisions.

Whether you’ve just launched your business or are a startup veteran, the following section is important. These eight steps will introduce you to the accounting process (if you’re not yet familiar) and set you up to scale your business in a sustainable way.

Note: This is simply an overview of the discipline of accounting. We recommend conducting more research and potentially hiring a professional accountant (which we’ll talk about below) to ensure you don’t miss any financial or legal obligations.

1. Open a business bank account linked to all points of sale.

For your first order of business, decide where to keep your money. This may vary based on your business’s legal structure. If your business is an LLC, Partnership, or Corporation, you are required to have a separate business bank account. If you’re a Sole Proprietorship, you don’t have to — but we still recommend it.

Having a separate bank account for your business income and expenses will make your accounting easier. You’ll only have one account to monitor for bookkeeping and tax purposes, and your personal income and expenses won’t get entangled with your business ones. Believe me — only having to look at one set of bank statements is a lifesaver during tax season.

Look for a bank that has a local branch as well as robust online banking. Also, be sure the bank can integrate with your point-of-sale (POS) system and other technological needs. Business bank accounts typically charge more than personal accounts and often have a higher minimum balance. Check these numbers before committing to a bank and a business account.

We recommend opening two accounts — one checking account and one savings account, the latter in which you’ll stash money for taxes and unforeseen expenses. And remember, before you can open any business accounts, you must have a registered business name.

Finally, consider opening a business credit card. Not only will this help offset some upfront expenses, but it will also contribute to your business’s overall credit. Also, Corporations and LLCs are required to have a separate line of credit outside their personal accounts.

2. Itemize all expenses by department.

Raise your hand if you’ve heard anyone say, “Hey, I can write that off!” I heard my parents say that a lot when I was younger — they’re both entrepreneurs — and I had no idea what it meant.

It wasn’t until I started my own venture in college that I came to understand tax deductions: they are a wonderful yet pesky benefit of owning a business.

Many business expenses are tax deductions — expenses that deduct from what you owe in taxes. For example, if I spent $500 to fly to and attend a marketing conference, that’s $500 less I owe in taxes for that year. The catch? In order to claim a deduction, you need to keep a record of that expense.

Historically, keeping, filing, and reviewing paper receipts was a time-consuming task. (My mom used to pay 10-year-old me to organize receipts by date and highlight the vendor and total amount … now I understand why.)

Today’s entrepreneurs have it much easier. Software, apps, and cloud-based bookkeepers have made it a breeze to track expenses and not have to keep hundreds of receipts lying around. Check out solutions like Rydoo, Expensify, Zoho Expense, and Shoeboxed to help manage your expenses.

Now, let’s discuss the expenses and supporting documentation you’ll be managing. While we can’t cover every possible deduction, here are a handful you should definitely keep a record of. (Why? Because they’re easy to mix up with personal expenses … and the IRS knows it.)

- Advertising and marketing expenses, such as paid social media ads, website hosting fees, and business cards

- Business travel, such as plane tickets, hotels, and rental cars

- Home office expenses, such as Wi-Fi, equipment, and mobile phones

- Vehicle-related expenses, such as mileage and gas

- Meals and entertainment, such as trips to coffee shops, cafes, or concerts (unless you don’t attend these events … then they’d be considered Gifts)

In case you need to support these expenses, we recommend that you keep the following documents. (Rule of thumb: When in doubt, keep everything.)

- Receipts (paper and digital)

- Bank and card statements

- Bills (for utilities, phone, internet, etc.)

- Canceled checks

- Invoices and documents showing proof of payment

- Financial statements from your bookkeeper or bookkeeping software

- Tax returns from previous years

- Any W-2, W-4, W-9, and 1099-MISC forms

Another common way to manage your expenses is by separating operating expenses from selling, general, and administrative (SG&A) expenses.

Operating and SG&A Expenses

Some companies decide to combine operating (OPEX) and SG&A expenses while some separate them (they can be combined on an income statement). Either option is totally fine — its about preference.

Here’s what you need to know about OPEX versus SG&A expenses:

- Operating expenses include costs related to your daily expenses and are often the majority of a business’s expenses (which is why many companies choose to combine these expenses).

- OPEX aren’t included in COGS — they’re the costs involved in the production of goods and services such as rent, utilities, insurance, inventory costs, salaries or wages, property taxes, business travel.

- SG&A expenses are incurred as daily business ops and are included in income statements (under “expenses”).

- SG&A expenses aren’t included in COGS (since they’re not associated with a specific product) and aren’t assigned to your manufacturing costs.

- If separated from OPEX, SG&A covers factors like accounting and legal expenses, ads and promotional materials, marketing and sales expenses, utilities and supplies that aren’t related to manufacturing, and corporate overhead (if there are executive assistants and corporate officers).

3. Adhere to all income, employment, and excise taxes.

Ah. If only bookkeeping meant hoarding the paperbacks I overbuy from my local bookstore … I’d be really good at that.

Unfortunately, bookkeeping isn’t always as fun. It’s another important account term that refers to the day-to-day recording, categorizing, and reconciling of transactions. Basically, bookkeeping keeps you from spending and making money without tracking it.

Bookkeeping is an ongoing task. Technically, you should be doing it every day, but we all know life can get in the way. Ideally, you should complete your bookkeeping every month so you can keep a thumb on the pulse of your income, expenses, and overall business performance.

Before we dive into how to do your bookkeeping, let’s cover the two main bookkeeping methods.

Cash Method

The cash method recognizes revenue and expenses on the day they’re actually received or paid. This method is the simplest for small businesses because it doesn’t require you to track payables or receivables and reflects whether or not your money is actually in your account.

Accrual Method

The accrual method recognizes revenue and expenses on the day the transaction takes place, regardless of whether or not it’s been received or paid. This method is more commonly used as it more accurately depicts the performance of a business over time.

The only thing it doesn’t show is cash flow — a business can look profitable but have zero dollars in the bank. If a business’s annual revenue exceeds $5 million, it’s required to use the accrual method.

Now, let’s talk about how you can do your bookkeeping.

4. Set up a payroll system.

Do you plan on hiring employees or contractors? Perhaps you’re managing on your own for now but are considering expanding in the future. Regardless, you’ll need to understand and secure a payroll system.

Payroll is another tedious yet required part of accounting. Thankfully, there’s plenty of software that can help you. (Hallelujah for modern-day technology, right? 🙌🏼) Check out solutions like Gusto, Zenefits, and Intuit Quickbooks Payroll.

Employees and independent contractors are classified differently and give your business different tax deductions. Here’s how to handle both.

Payroll For Employees

You can deduct employee wages (salaries and commission bonuses) employee education expenses and employee benefits (accident and health plans, adoption assistance, life insurance, and more) from your taxes.

You can also deduct payroll taxes, which are employment taxes paid on behalf of your employees (like Social Security and Medicare as well as federal and state unemployment taxes).

Employees should submit a W-4 form so you know how much tax to withhold. In exchange, you should provide employees with a W-2 form, which summarizes their yearly gross pay. They use this to pay personal taxes.

Payroll For Independent Contractors

Independent contractors include freelancers, consultants, and other outsourced experts that aren’t formally employed by your business. With contractors, you don’t pay benefits or withhold taxes on their behalf.

Because of that, contractors should submit a W-9 form so you have their business information (such as their SSN or EIN), and you should provide a 1099-MISC form in exchange (if you pay them more than $600 per year).

A 1099 form tells the government how much you spent for their services — so you can write this amount on your tax return, and so they can assume the tax burden on their return.

5. Identify the right payment gateway for your needs.

We’ve talked about your method of paying employees and contractors. Now, let’s talk about how you’ll receive money for your goods and services. (This sounds like more fun, huh?)

Your method of collecting money is often referred to as your payment gateway. Whether you provide freelance services, set up shop at a local farmer’s market, or run a global e-commerce business, you need an easy (and legal) way to collect what you’ve earned.

Depending on the nature of your business, how you collect money will vary. Let’s go over some options.

Payment Gateway For Service Provider

As a freelance writer, I rarely work with clients in person. In fact, I’ve only ever officially met one of my clients — the rest I work with purely over email. Because of that, I collect most of my payments through an online gateway.

PayPal is a popular choice for collecting payments. You can also use software like Wave, Xero or Bench. Not only can you invoice clients through these programs, but you can also conduct bookkeeping, payroll, and other accounting tasks. These charge fees, though, so consider that when making your decision.

Another way to collect payment is through mobile applications like Venmo or Square Cash — just be sure to send an invoice as proof of payment. Lastly, you can always collect payment via check … it just takes a bit longer than an online transfer. (Send an invoice with this method, too.)

Payment Gateway For Storefront Business

Collecting money in person (at a storefront, marketplace, etc.) can get pricey. Between equipment, credit card fees, and handling physical cash, it can be a hassle. Thankfully, Square and PayPal make it easy to accept card payments using your smartphone or tablet. These programs also send your customers receipts, reconcile your transactions, and handle returns if necessary.

If you expect a high influx of daily purchases, we recommend choosing a more robust POS system and more reliable equipment (like a register and dedicated card reader).

Both Square and PayPal offer this option, too. With this option, you’ll need to set up a merchant account with your bank. (This account acts as a middle ground between your POS system and main bank account.)

Payment Gateway For Ecommerce Business

Ecommerce platforms like Shopify, BigCommerce, and WooCommerce often provide built-in payment gateways. These are always the easiest to adopt as they’re already integrated with your website. You could also use third-party payment solutions like Stripe.

6. Understand the tax obligations for your type of business.

Taxes are inescapable. Thankfully, they’re easy to prepare for. The best way to do so is to educate yourself on your business’s tax obligations, keep accurate records, and set aside revenue (or pay ahead in quarterly taxes).

Paying taxes as a small business is slightly more complicated than it is as an individual. The amount and type of taxes you file will depend on a few things: your business’s legal structure, if you have employees (and how many), and if you collect sales tax.

This part of accounting — tax obligation and collection — is particularly tedious. We highly recommend that you work with a professional to at least ensure your business is following the proper procedures and laws.

7. Regularly review and evaluate your methods.

Similar to other processes and strategies across your business, you’ll want to constantly review and evaluate your accounting methods. You should always have a controlled process in place for your business accounting — because, as you’ve learned throughout the above sections, it’s an absolutely critical aspect of your company’s overall health.

The frequency in which you review and evaluate your methods is bound to be unique to your specific business. However, it is normal (and recommended) to audit your process at the end of every month, quarter, and year. This way, nothing slips through the cracks or becomes a problem that’s too large to bounce back from.

If the nature of your business is seasonal, you can tailor different factors like the frequency of your evaluation to this cycle. For instance, you might require more reviews of your accounting process during high season, and fewer during slower months.

8. Consider a professional service or CPA.

As important as it is to understand how business accounting works, you don’t have to do it alone. That’s where professional accounting services and CPAs come in.

If your budget allows, we highly recommend hiring a professional to help with your accounting. Here’s how you can go about doing so.

- Ask for a referral from a trusted friend or another entrepreneur. If you’re part of any business groups or networks, ask for recommendations there, too.

- Use the CPA directory.

- Use Yelp for local professionals.

Whomever you choose, be sure to read plenty of reviews and testimonials about your potential accountant. Inquire about his or her experience in your industry, rates, and services, and make sure you’re comfortable with how and how often you’ll communicate with your accountant before you sign anything. Set all expectations upfront.

Also, if you have the funds, hiring an in-house accountant is always an option. This person would be responsible for your business’s accounting only and be a contractor or full-time employee.

Learn Business Accounting to Grow Better

Business accounting might seem like a daunting mountain to climb, but it’s a journey well worth it. Accounting helps you see the entire picture of your company and can influence important business and financial decisions.

From practicing calculations to understanding your company’s tax obligations, mastering the discipline of accounting can only help your business grow better.

Even if you opt to use accounting software or hire a professional, use the tips we’ve reviewed in this guide to learn about and master accounting basics. Your business will thank you.

Editor’s note: This post was originally published in May 2019 and has been updated for comprehensiveness.

[ad_2]